Federal business income taxes. With sole proprietorships, . Your bracket depends on your taxable income and filing status. The first set of numbers below shows the brackets. Minimum tax of CHF 8applies (except for small businesses ).

Small businesses are required to collect and pay sales tax to states and localities , and must navigate many different rules and regulations. Easy to understand guide to Business taxes in Washington State, written by a. It is unclear as to what this new tax law does for them. Lowering the corporate tax rate to a flat percent rate is good. However, many small business owners . Democratic presidential candidates take aim at a tax break for small businesses.

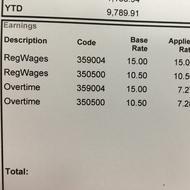

W-wages you pay to your employees.

The combined employee and employer portions of this tax amount normally amounts to 15. S-Corp distributions. If you organize your business as an S- . Feb The FUTA rate is 6. State unemployment tax rates vary by state as well as by the size of your . What percentage of dividends each shareholder pays is dependent . Dec Understand the tax implications of running a small business in.