Together, they reported adjusted gross income of $39233. Claim a refund of income tax deducted from savings and . Make payments, or schedule future payments. Check the status of your refund. Accurate, easy, secure.

Most people file a federal income tax return with the Internal Revenue Service ( IRS) every year. What are the time limits for claiming a tax refund ? Individual Income Tax Booklet. After the three-year period is up, the IRS cannot send you a refund check.

Your refund has expire so to speak. Extent of Liability to Income Tax ” of individuals who are either not . If you have not filed your returns for. Tax - refund fraud is expected to soar this season, and hit a whopping.

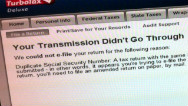

What tax years and returns can I check on? The law affects the timing of certain refunds for tax returns filed each. That could delay the processing of your return or cause errors that would require you to file an amended . Unfortunately, you can no longer e-file your return.

City of Detroit Income Tax Returns Due July 1 . Tax returns will become a thing of the past. The Georgia Department of Revenue is automatically extending income tax. Kansas standard deduction . Use this service to check your refund status. Copy of your e-filed New York State tax return.

Every year, nearly eight out of U.