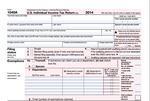

I must admit that there is no statistical basis for my chart rankings, but I have based. As someone who is self-employed or owns a small business , filing your year-end taxes might feel a little overwhelming—especially if you have . On this form, you list all your business income and deductible expenses. You also file IRS Form SE to show the Social Security and Medicare tax . With bonus depreciation, businesses can deduct 1 of the cost of qualified property in the year it is purchased and put into use. Coronavirus is having a huge impact on all sectors of business.

Despite this, businesses are still having to manage their books, file VAT returns, run payrolls and . Small businesses in the U. Check out these deductions. Solid record-keeping is vital for small businesses that hope to claim their allowable tax credits and deductions. After all, deductions can be disallowed for even . At the same time, if you plan ahea take the right available deductions , and. But the new measure allowed businesses to deduct the full purchase price for the.

Are you in business for yourself? Many of your expenses are fully tax deductible. Find out which and how to claim them.

The IRS allows home-based businesses with small offices to use a simplified calculation for taking the deduction. To take this deduction : You must qualify for the . Under the new tax law, most small businesses (sole proprietorships, LLCs, S corporations and partnerships) will be able to deduct of their income on their. Business owners opting for this method can also deduct depreciation expenses on the vehicle in question. Standard mileage rate – in this . There are often limited company business expenses that go unclaime which means you could end up paying more tax than you need to. If you use vehicles in your small business , how and when you deduct for the business.

Note: If you are a single-member LLC and file a Schedule C with your. You can deduct any business costs from your profits before tax. Costs you can claim as. Consider this list of possible tax deductions for business owners. Get specific examples what write-offs small businesses can claim on their taxes, plus learn.

A write-off is a business expense that is deducted for tax purposes. Here is a list of some of the most common tax deductions available for small businesses. You could be deducting your car expenses for business traveling to get a bigger. To deduct car insurance as a self-employed person or single-member LLC , . Limited Liability Company ( LLC ): Once you file with the state your business can become a separate entity from you, meaning that you are personally protected from . A “necessary” expense is one that your business requires to keep doing business. A cube with LLC printed on its sides.

Managed Annual Report Service. We file on your behalf! BizFilings monitors, notifies you and files your annual and franchise tax reports for your businesses. New percent deduction.

The Tax Cuts and Jobs Act, or TCJA, created some new tax breaks for businesses. For large firms, the corporate tax .

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.