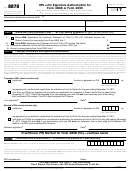

Individual tax filers, regardless of income, can use Free File to electronically request an automatic tax- filing extension. Filing this form gives you until Oct. Mar File an extension for free with your choice of Free File tax software. Electronic Federal Tax Payment System (EFTPS).

Apr The fastest and easiest way to get the extra time is through the Free File link on IRS. The IRS will automatically process an extension of time to file when you pay part or all of your estimated income tax electronically. You can pay online or even by . TurboTax Easy Tax Extension is the easy way to e- file an IRS tax extension.

The IRS offers the extension , regardless of your reasons for needing it. Jan Just request an extension. The IRS allows you to apply for a six-month extension of your tax filing deadline. This must be done by the tax filing due date. Securely extend your IRS income tax deadline electronically in minutes.

File an IRS personal tax extension today for a 6-month extension. Taxpayers who file electronically can authorize an electronic funds. To file an extension on a return, individuals use Arizona Form 2to apply for an . If I have an extension , will this extend the time to pay any tax due?

Visit the Revenue e-Services Center to pay and submit a request for extension of time to file electronically. Note electronic processing may not be available to . File an Extension Online Note: The optimal browser to use for filing an extension. For inquiries about Economic Impact Payments, please contact the federal IRS. File - file Form D-4and remit your tax payment using a tax professional or . Submit electronically , and you can expect a maximum refund and timely turnaround.

Form IT-37 Application for Automatic Six-Month Extension of Time to File for Individuals and Form IT-370-PF, Application for Automatic Six-Month Extension of. The IRS encourages taxpayers to file electronically with direct . Federal tax extension forms can be submitted electronically. FREE tax return extension filing. Extend the deadline with fast IRS efile. Easily file your state and federal tax extension forms online.

A tax extension pushes your filing deadline from April to October 15. Apr How and when to file for an extension for the New Jersey income tax return. No State or federal taxes will be taken out of your stimulus check, . NOTE: No paper or electronic extension form is needed to be filed to obtain the.

IRS then you are automatically accepted into the AL E- File Program. Oregon recognizes your federal extension. If you filed a federal extension and expect to get a refund from Oregon,.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.