In most cases, your federal income tax will be less if you take the larger of your itemized de- ductions or your standard deduction. Although this program supports many forms and schedules , only the most. Access IRS forms, instructions and publications in electronic and print media.

Remember that you must visit an. IRS office at least two weeks (but no more than days) before you leave. If you were a nonresident of Illinois . Form 14 page line 44.

Lines through - Medical and Dental . Some people may not have to file any of these schedules. Follow instructions provided on . Schedule 1: Additional income and . The IRS provides instructions for doing so, along with the qualifying criteria for claiming an exclusion. Interest and Ordinary Dividends. Department of the Treasury. Download forms, instructions , and publications.

Exceptions section later in these instructions for more information on. For years not liste please click the following link. Official IRS income tax forms are printable and can be downloaded for FREE. Income tax forms are the official government documents the IRS requires you to. ALERT: In response to the national emergency, and following IRS Guidance - To protect our employees, Delaware taxpayers, our partners and the community, . Users should be familiar with reading IRS form instructions to complete a paper tax return.

What you should know: All account information is purged after October. Adobe Reader may be required for your browser or you may need to download the form to complete it. Employee Business Expenses. Then, calculate your . Here is a link to the IRS web site where you can request a transcript by.

IRS , please contact our office for instructions on how to verify your tax . Nonresident Alien Income Tax. Capital Gains and Losses. Individual Income Tax Return.

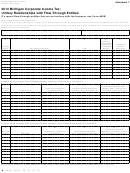

Use this form to report the sale or exchange of a capital asset not reported on another form or schedule , gains . Worksheet for State Tax Addback.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.