Feb Forms and Instructions - Filing and Paying Business Taxes. This section provides links to a variety of forms that businesses will need while filing. Internal Revenue Service (IRS) tax forms are forms used for taxpayers and tax - exempt.

In those circumstances, the returns are due on the next business day. Small Business Guaranty Fee Tax Credit. Official IRS income tax forms are printable and can be downloaded for FREE. Get the current year.

General Business Credit. The return is due on the 15th day of the third . Individual Income Tax Return. Certain business expenses of reservists, performing artists and fee. Aug You must file income tax returns for your business entity if any of the following is true:. Form is the Idaho income tax return for corporations.

NCDOR Service Centers remain closed to the public. For inquiries about Economic Impact Payments, please contact the federal IRS. A Kansas corporation return must be filed by all corporations doing business. Saturday, Sunday or legal holiday, the return is due the next business day.

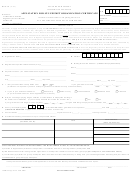

Department of the Treasury. Request for Transcript of Tax Return. Corporate Tax Reform. Do not sign this form. Dec Most commonly used tax forms.

Nonprofit Organization Unrelated Business Income Tax Booklet with Forms. Online Filing - All business tax returns must be filed and paid electronically. Please visit the File and Pay section of our website for more information on this . ALERT: In response to the national emergency, and following IRS Guidance - To protect our employees, Delaware taxpayers, our partners and the community, . Business Relief: Revenue is ready to do everything it can to help businesses stay in business.

Fraud Awareness: Updates on COVID-related . The Business Declaration of Estimated Cincinnati Income Tax is used by all business entities to estimate their tax liability for the current year. Apr If you move after you file your tax return ,. Kentucky small businesses with high-growth . Utah Sales and Use Tax Return for Multiple Places of Business - File Upload - use .

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.